Mobile Homes and Travel Trailer

Can You Change Insurance Agents Within the Same Company?

You can switch insurance agents without changing companies by submitting a Broker of Record letter. Your coverage stays the same while your new agent handles service and support. It’s a simple way to get better communication, guidance, and overall insurance experience.

Read MoreAre Solar Panels Covered by Insurance in Texas? Full Explanation

Yes, many homeowners’ insurance policies do cover solar panels, but the exact nature and extent of that coverage can vary widely. Here are a few points to keep in mind: Part of the Dwelling or Personal Property: Depending on how the solar panels are installed and attached, they may be considered part of the dwelling…

Read MoreDoes Home Insurance Cover Earthquake Damage in Texas?

In Texas, as in most other states, standard homeowners’, landlord, and mobile home insurance policies typically do not cover damage caused by earthquakes. However, homeowners can purchase a separate earthquake endorsement or a standalone earthquake insurance policy to cover such damages. If you’re considering earthquake coverage in Texas, keep in mind: Coverage: Earthquake insurance typically…

Read MoreDoes Home Insurance Cover Moving? Texas-Specific Insights and Options

Relocating can be a complex and stressful process, and ensuring your possessions are protected during the move is crucial. In Texas, where the climate and weather conditions can add additional considerations, it’s essential to understand how your home insurance handles moving and what steps you can take to safeguard your belongings during the transition. Understanding…

Read MoreHow to Get Home Insurance to Cover Your Air Conditioner: A Step-by-Step Guide

Getting your home insurance to pay for your air conditioner can be straightforward for some, but coverage varies depending on your policy. Even if you have valid coverage, you might encounter resistance from your insurance provider. Fortunately, there are steps you can take to resolve coverage issues for your HVAC unit. Understanding Homeowners Insurance Coverage…

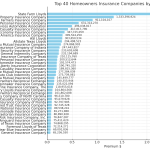

Read MoreThe 40 Largest Home & Landlord Insurers in Texas

The Texas homeowners and rental property insurance market is dominated by a few major players, with the top 40 companies holding a significant portion of the market share. In 2022, these leading insurers collectively wrote $11.68 billion in premiums, accounting for 87.42% of the total market, which amounted to $13.36 billion. State Farm Lloyds leads…

Read More4 Types of Water Damage Coverages Available For Texas Home Insurance Policies

As the anniversary of Snowmageddon 2021 draws near, I find myself pondering the extensive water damage that occurred. While I may not have a foolproof guide to preventing pipe bursts in the absence of electricity or heat, it’s essential to understand the variety of water-related claims and their coverage status. Sudden and Accidental Leaks: Description:…

Read MoreWhat Does TWIA Insurance Cost and What Does It Cover?

The average premium on a TWIA residential policy is approximately $2,000 (as of 6/30/2023). To get the lowest rate your agent needs to check all factors and discounts like the WPI-8 certificate discount. The Texas Windstorm Insurance Association (TWIA) was established in 1971 to provide windstorm and hail insurance for Texas Gulf Coast property owners in…

Read MoreState Farm Home and Auto Insurance Review in Texas

State Farm has a strong presence in the Texas auto and home insurance markets, offering a wide range of coverage options and discounts. The company is known for its customer service and has a reputation for handling claims effectively. State Farm Auto Insurance Review For auto insurance, State Farm’s Texas rates are competitive, with the…

Read MoreThe Benefits of a Spanish speaking Home and Auto insurance agent in Texas

Having a Spanish-speaking Texas insurance agent can offer several benefits, particularly for individuals or families who primarily speak Spanish or feel more comfortable communicating in their native language. Here are some of the advantages: Clear Communication: Effective communication is essential when discussing insurance policies, coverage options, terms, and conditions. By working with a Spanish-speaking agent,…

Read More